Cryptocurrency

Mining for proof-of-work cryptocurrencies requires enormous amounts of electricity and consequently comes with a large carbon footprint due to causing greenhouse gas emissions https://thewinport.net/. Proof-of-work blockchains such as bitcoin, Ethereum, Litecoin, and Monero were estimated to have added between 3 million and 15 million tons of carbon dioxide (CO2) to the atmosphere in the period from 1 January 2016 to 30 June 2017. By November 2018, bitcoin was estimated to have an annual energy consumption of 45.8TWh, generating 22.0 to 22.9 million tons of CO2, rivalling nations like Jordan and Sri Lanka. By the end of 2021, bitcoin was estimated to produce 65.4 million tons of CO2, as much as Greece, and consume between 91 and 177 terawatt-hours annually.

On 13 September 2018, Homero Josh Garza was sentenced to 21 months of imprisonment, followed by three years of supervised release. Garza had founded the cryptocurrency startups GAW Miners and ZenMiner in 2014, acknowledged in a plea agreement that the companies were part of a pyramid scheme, and pleaded guilty to wire fraud in 2015. The SEC separately brought a civil enforcement action in the US against Garza, who was eventually ordered to pay a judgment of $9.1 million plus $700,000 in interest. The SEC’s complaint stated that Garza, through his companies, had fraudulently sold “investment contracts representing shares in the profits they claimed would be generated” from mining.

Neither Atomic Invest nor Atomic Brokerage, nor any of their affiliates is a bank. Investments in securities are Not FDIC insured, Not Bank Guaranteed, and May Lose Value. Investing involves risk, including the possible loss of principal. Before investing, consider your investment objectives and the fees and expenses charged.

Cryptoassets are digital assets stored on a blockchain. Cryptoasset transactions are encrypted using cryptography and serve as a potential alternative to government-backed fiat currencies. Traditionally, cryptoassets are considered to be decentralised, meaning they are controlled by a network of users, rather than a single point of authority.

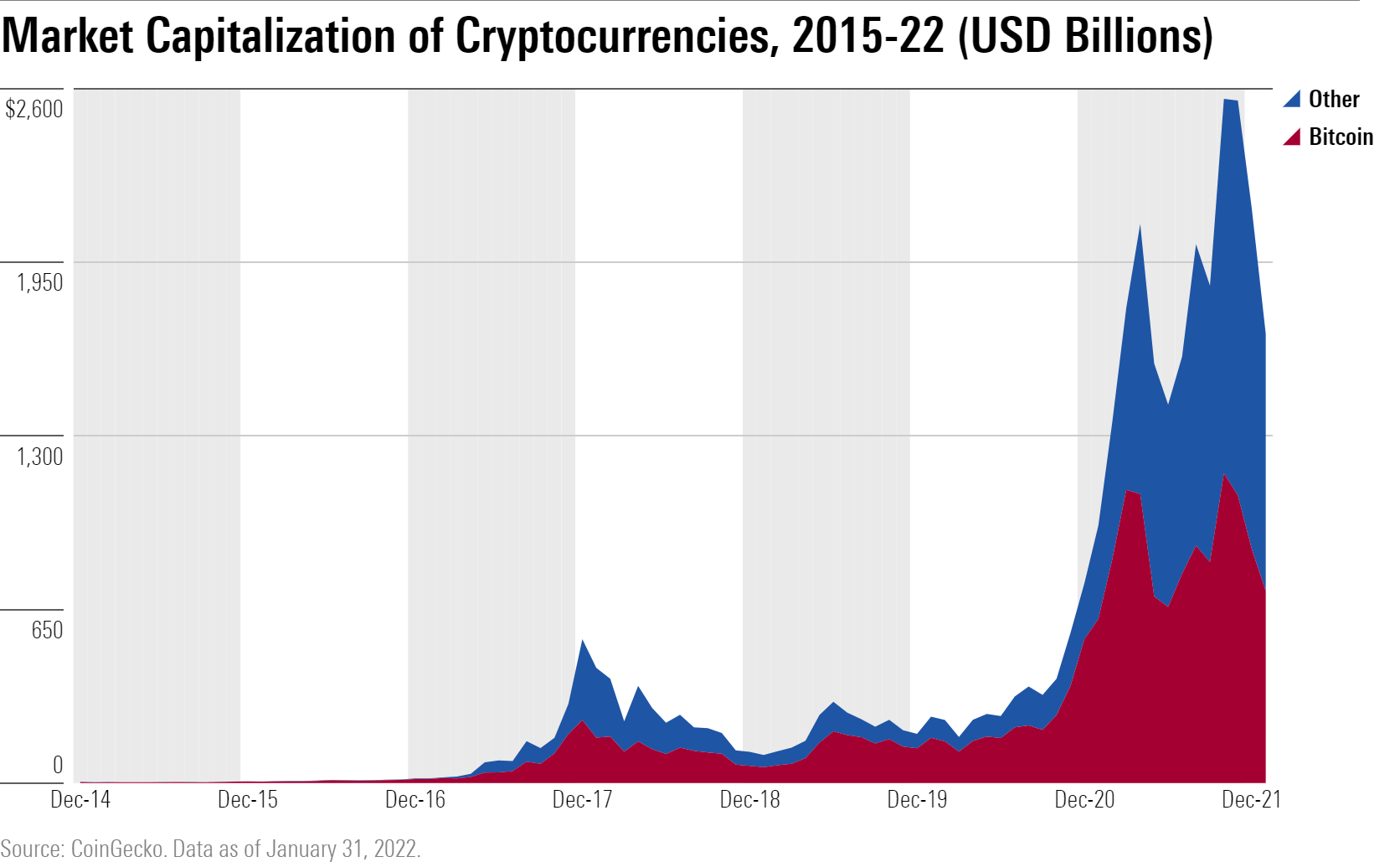

Cryptocurrency prices

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

Top cryptocurrencies such as Bitcoin and Ethereum employ a permissionless design, in which anyone can participate in the process of establishing consensus regarding the current state of the ledger. This enables a high degree of decentralization and resiliency, making it very difficult for a single entity to arbitrarily change the history of transactions.

One of the biggest winners is Axie Infinity — a Pokémon-inspired game where players collect Axies (NFTs of digital pets), breed and battle them against other players to earn Smooth Love Potion (SLP) — the in-game reward token. This game was extremely popular in developing countries like The Philippines, due to the level of income they could earn. Players in the Philippines can check the price of SLP to PHP today directly on CoinMarketCap.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

Top cryptocurrencies such as Bitcoin and Ethereum employ a permissionless design, in which anyone can participate in the process of establishing consensus regarding the current state of the ledger. This enables a high degree of decentralization and resiliency, making it very difficult for a single entity to arbitrarily change the history of transactions.

Cryptocurrency regulation sec

In addition to FinCEN reporting requirements, ordinary income from virtual currency must be reported in accordance with Form 1040 or other relevant tax forms. Businesses may also be required to report digital asset transactions on Form 8300. Maintaining accurate records of all cryptocurrency transactions is essential for meeting tax obligations and ensuring compliance with regulatory requirements.

On top of this, President Biden has also proposed a rule that requires crypto exchanges and other businesses to report any cryptocurrency transactions with a market value of $10,000 or more to the IRS. This has not yet been enforced, but it could be in the near future.

An array of crypto exchanges have also been scolded by the SEC in the past, which has fueled the agency’s bid for regulation. For example, in 2022, the SEC probed the hugely popular exchange Coinbase amid suspicions of unregistered securities trading. Coinbase pushed back against this allegation, and the SEC has not yet announced an official investigation. But such actions highlight that this agency is now geared towards keeping crypto companies in check.

The SEC has a broad set of regulatory tools that can be tailored to address cryptocurrencies’ unique characteristics and challenges. Here are the types of regulations the SEC could adapt to the crypto market: